Service

Providers

A valued partnership

So Joe highly values the connection we have with service providers. As a fellow service provider, we understand how important it is to work well together to help achieve the greatest successes for NDIS participants. We also know how important it is to be paid for the work you’ve completed in a timely matter. Meeting these needs is the So Joe guarantee.

We work with providers to individualise the collaboration with them as a foundation to a successful long-term partnership together. We also have one of the fastest invoice processing times in the NDIS sector and have great attention to detail & accuracy.

Invoice processing

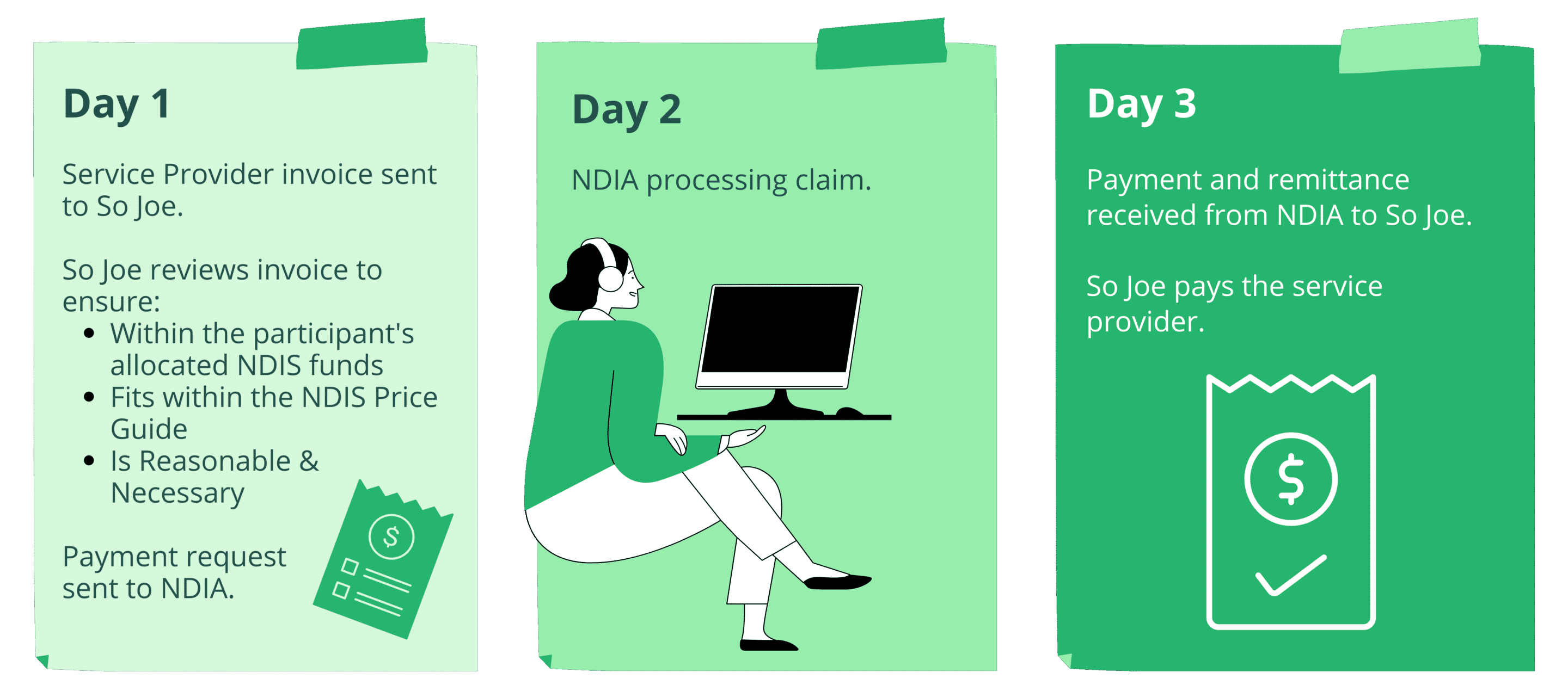

As a registered Plan Manager for the NDIS, we process invoices for NDIS participants who are registered with our service. Our role is to ensure that invoices are compliant within NDIS standards & pricing guidelines and the funding is within a participant’s remaining NDIS plan budget. We also monitor for potential fraud of a participant’s funds.

What to expect?

Invoice essentials

To allow So Joe to process an invoice, the NDIS requires service provider invoices to include:

- Service providers business name

- Service Provider contact information

- Phone/Email for invoice queries

- Email for remittance advice

- Australian Business Number (ABN)

- Invoice number

- Account details for payment (BSB and account number)

- Participants details

- Name

- NDIS # (if known)

- Service details

- Service provided

- NDIS line item number (if known)

- Quantity provided

- Rate of support (e.g. hour rate)

- Invoice Date.

Charging for

services

Price Guide

All services provided must be invoiced within the relevant NDIS Price Guide. Services provided which exceed these limits cannot be claimed against the participant’s NDIS plan funding.

GST

Majority of NDIS services are GST-free. GST does not need to be charged simply

because you are registered for GST. All self-care support and social & community

participation are GST-free. The Australian Tax Office (ATO) can provide further

information to determine if GST applies. https://www.ato.gov.au/business/gst/in-detail/your-industry/gst-and-health/?page=6

For ATO Business Support ph. 13 72 26

NDIS Budgets

All participant invoices will be billed against the individual participant’s related NDIS budget. If the budget has been expended, there may be scope to process this under another area of funding which has funds remaining if it fits within the guidelines. If the participant’s funding has been expended for a specific category of support, the invoice will unable to be processed.

Participant Privacy

It’s important to note that So Joe is unable to provide personal or financial details

related to the participant in respect of their privacy unless prior consent has been

provided.